reit dividend tax rate

3 hours agoPLEASE BE ADVISED THAT THE INTEREST RATE FOR THE PERIOD 16-May-2022 TO 15-Aug-2022 HAS BEEN FIXED AT 216 PCT DAY BASIS. See why we rate MPW.

Reit Taxation A Canadian Guide

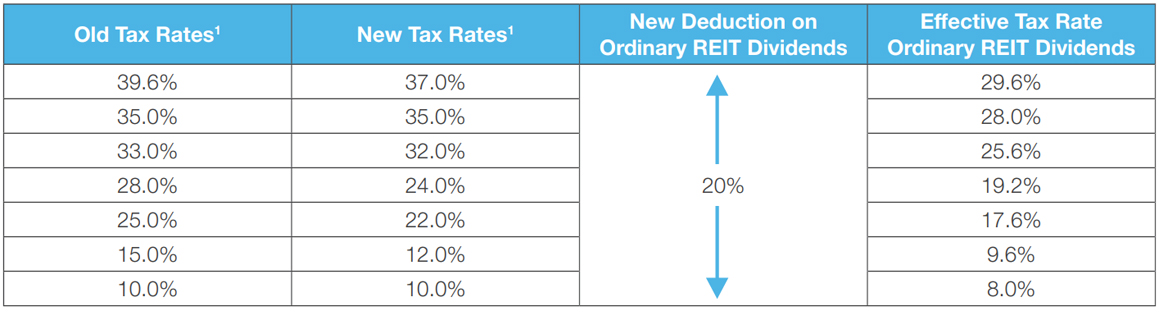

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

. Ad The Market Junkies picks for the 3 best dividend stocks to invest in for massive yield. Tax benefits of REITs. Please refer to the table below.

Post Q2 2022 results shares of Medical Properties Trust fell further more than 30 ytd despite the fact that its dividend payment keeps growing. Ordinary dividends are taxed. The dividend is paid with respect to a class of stock that is publicly traded.

1 2020 to accurately reflect US. Nareit has updated its tax treaty chart through Jan. Taxation considerations for income from investing in InvITs and REITs.

The majority of REIT dividends are taxed. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. In general the 20 percent maximum capital gains tax rate plus the 38 percent Medicare Surtax applies to the sale of REIT stock.

New Tax Foundation modeling finds that the Inflation Reduction Act would result in a net revenue increase of about 304B but would do so in an economically inefficient manner. Invest With Us For Real Estate Expertise Across Major Asset Classes And Markets. Any money distributed by an InvIT or REIT like interest dividend or rental income for.

Preferred Canadian Dividend Tax Rate. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts. REITs voting stock and in the.

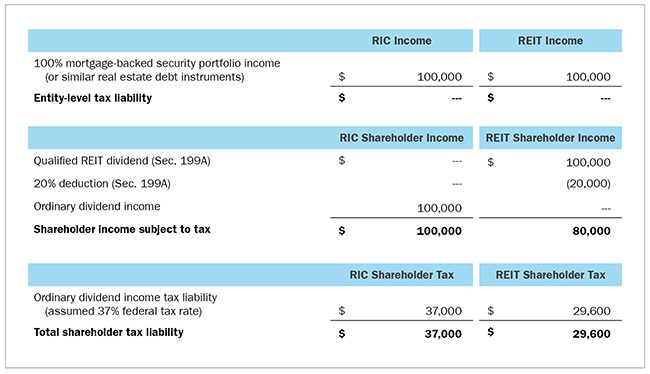

Since REIT dividends are taxed at the individual shareholders rate rather than the corporate rate the 20 pass-through deduction reduces their top tax rate from 396 down to 296. 15 rate 10 rate in Bulgaria and Japan only if. REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f REITs gross.

Does the down market have you down. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. The taxes that you as an investor will pay on those.

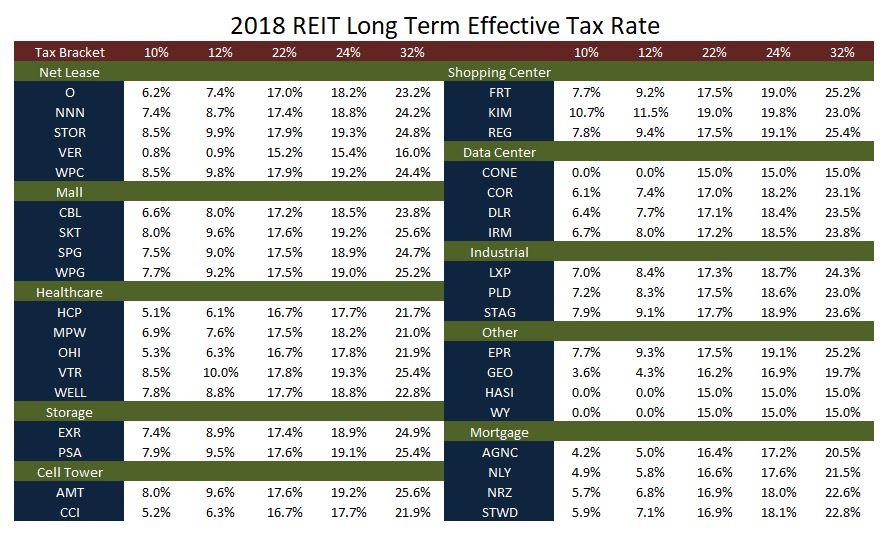

What are Qualified Dividends. The tax law effectively lowered the federal tax rate on ordinary REIT dividends mortgage REITs included from 37 to 296 for a taxpayer in the highest bracket. Of Tax Rate to Fund Black Lung Disability Trust Funds Trust Fund and the Section 13901 Under current law an excise tax is imposed on coal from mines in the United.

We have top picks to help you weather the storm. Investor owns 5 or less of a REIT listed on a US. The dividends distributed to investors by a REIT can either be considered ordinary income or qualified income.

Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. Ad Tap Into Broader Resources Such As Macro Analysis Credit Research And Risk Management. Canadian Distributions REITs Income Trusts Normal income.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US. 5 tax rate if the corporate shareholder owns at least 10 of the.

Withholding tax rates on ordinary REIT dividends to non-US. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000. Investors receive reports that break down the income and.

PID dividends are not considered as part of your annual. A dividend is a distribution of a corporations earnings to its shareholders and dividends can be either ordinary or qualified. The REITs gross income consists of interest and dividends.

This company is required by law to distribute 90 of its taxable income to shareholders. Individual REIT shareholders can deduct 20. A portion of a REIT dividend payment may be a capital gains distribution which is taxed at the capital gains tax rate.

The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. Instead the REIT withholds the basic income tax rate of 20 on your PID dividends and pays out the remaining 80 to you. This level is still above the.

Guide To Reits Reit Tax Advantages More

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Understanding The Reit Taxation Rules Novel Investor

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Reit Taxation A Canadian Guide

Uk Dividend Tax 2020 Reit Dividends Tax Us Stocks Etc Dividend Dividend Stocks Reit

Sec 199a And Subchapter M Rics Vs Reits

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

How Tax Efficient Are Your Reits Seeking Alpha

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com